FLIGHT CENTRE TRAVEL GROUP LIMITED

CORPORATE GOVERNANCE STATEMENT

Flight Centre Travel Group Limited (FLT) endorses the ASX’s Corporate Governance Principles and Recommendations and complies with each recommendation, apart from amalgamating the Remuneration Committee and the Nomination Committee as outlined in Section 2. This statement is current as at 30 June 2016 and has been approved by the FLT board.

1. Lay solid foundations for management and oversight

Roles and responsibilities of the board and management

The board acknowledges that its primary role is to create and safeguard shareholder value.

The board's functions include:

- Charting the group's direction, strategies and financial objectives

- Overseeing and monitoring organisational performance

- Identifying risks and implementing appropriate control, monitoring and reporting mechanisms

- The chair's appointment

- Appointment, performance assessment and, where appropriate, removal of the chief executive officer (CEO), chief financial officer (CFO) and company secretary

- Ensuring board structure and composition is effective

- Approving and monitoring major capital expenditure, capital management, acquisitions and divestitures; and

- Approving the incorporation and deregistration of all FLT group entities

The chairman leads the board in meeting its responsibilities to FLT stakeholders. Under FLT's constitution, the board can also delegate any of its powers to the managing director (MD). Those powers can be withdrawn, suspended or varied at any time.

The MD, CFO and the other senior executives are authorised to make day-to-day decisions required to fulfil their roles and to achieve the company's strategic and financial objectives. The company secretary is directly accountable to the board through the chairman on all matters to do with the board's proper functioning.

Senior executives report to the board each month to update it on initiatives and issues. These reports include key performance indicators (KPIs), which are the basis of executive performance evaluations.

The full board deals with all significant matters. To assist in its deliberations, the board has established various committees that act primarily in a review or advisory capacity.

Regional operational committees are in place in New Zealand, the United Kingdom and the United States. These committees may include board directors, who work with the senior executive and his or her key management personnel to develop their businesses and address issues that may arise.

Checks undertaken prior to appointment

Before appointing a director, or putting forward to security holders a candidate for election, appropriate checks are undertaken in relation to such persons, including checks as to a candidate’s character, expertise, education, criminal record and bankruptcy history. All material information is provided to security holders with regard to the decision on whether or not to elect or re-elect a director. FLT has a written agreement with each director and senior executive setting out the terms of their appointment.

Diversity Policy

FLT has expanded its longstanding Equal Employment Opportunity policy to create a Diversity Policy, which is in line with ASX requirements and available on the company’s corporate website.

The company continues to follow a best practice recruitment process to ensure all selection is conducted on experience, merit and competency based on key selection criteria for each role. All policies, procedures and advertising are reviewed to ensure no gender bias occurs and the most suitable person is selected. Compulsory online training modules have been developed to enhance the policies’ effectiveness.

Targeted remuneration packages are based on the role being performed and are the same for all staff in that particular role. This ensures there is no gender bias. Similarly, incentive earnings are not gender biased, as they are based on the employee achieving measurable performance hurdles.

Where possible, FLT seeks to identify and develop leaders from within its ranks. Currently, about 71% of staff members are women and 49% of FLT’s senior leaders (defined as area leaders and above) are women.

The board has also established a directorship policy for its subsidiaries that has exposed more staff of both sexes to director roles and responsibilities. Under this policy, the relevant executive general manager (EGM) is appointed a director and receives valuable training and experience.

Under FLT’s diversity measurable objectives, the company seeks to ensure that at least one woman is shortlisted as a candidate for all board and executive management level roles. During the 2015/16 financial year, there were no changes to the FLT board and the board had 5 members, including one woman. On 2/8/16 Cassandra Kelly resigned, FLT is currently recruiting for this vacancy.

FLT also has a range of strategies and programs to achieve specific gender diversity targets. Some of the programs include implementing a development program across the FLT group to provide career progression paths for all employees and initiatives to embrace an inclusive work place culture.

Board evaluation

The company follows an established process for periodically evaluating the performance of the board, its committees and individual directors. Board members and other senior executives evaluate the board on its overall performance and individual directors' performance. The board as a unit is assessed on board process and dynamics, while the individual directors and chairman are assessed on leadership, interaction with other directors and senior executives, imparting of knowledge, attendance and involvement in decision making. The board may also engage an external facilitator to help conduct periodic performance reviews. During the 2015/2016 financial year, FLT did not engage an external facilitator.

The board is evaluated annually based on its performance during the financial year and was evaluated during the 2015/2016 financial year.

Senior executive evaluation

FLT’s senior executives are subject to informal performance evaluation by the managing director and the task force. This evaluation includes measurement of performance against set KPI's. The process was undertaken during the 2015/2016 financial year.

2. Structure the board to add value

The board has a complementary mix of skills that provides the desired depth and experience. During the 2015/2016 financial year, the board consisted of four independent non-executive directors (including the chairman) and one executive director, who is the MD.

The board generally meets monthly and on an ad hoc basis to consider time critical matters.

Directors may seek legal advice, at the company's expense, on any matter relating to the group, subject to prior notification to the chairman. FLT provides additional updates and training to board members on matters relating to their roles. Examples may include corporate governance updates and the impacts of recent court rulings involving such topics as directors’ duties, disclosures and transactions.

Board composition

The directors' names and biographical details are provided in the annual report's Information on Directors section.

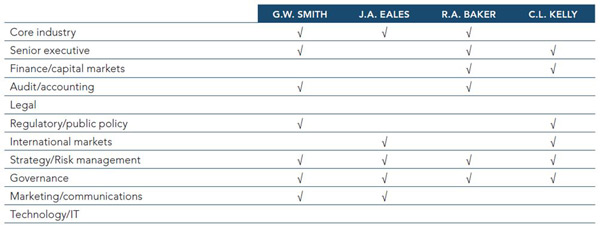

At all times, the board is to have a complementary mix of financial, industry and listed entity knowledge and experience. The board believes the current members have the necessary knowledge and experience to direct the company in its current operations. A summary of the breadth and depth of the board’s experience and skills appear below:

Remuneration and Nomination Committee functions

FLT's Remuneration and Nomination Committee includes FLT’s four non-executive directors. Due to the board’s small size, FLT has a combined Remuneration and Nomination Committee. Consequently, the Remuneration and Nomination Committee considers (per the charter) board composition to ensure it includes the appropriate blend of skills and competencies to oversee the company.

The Remuneration and Nomination Committee establishes whether to nominate a further director, if a board position becomes available or where additional skills may be required at board level. For example, if the company chose to access a new region or sector, the committee may consider appointing an additional director with appropriate experience.

Where the Remuneration and Nomination Committee recommends the nomination of a further director, the board may engage a professional recruitment firm to identify candidates that fit the criteria being sought to complement the board and its existing skills set. Other factors to be considered when appointing a new director will include references, ability to devote time to the role, cultural fit, strong financial acumen, technology knowledge and residential location.

Once a short list is created, the Remuneration and Nomination Committee will interview candidates.

Ultimately, a candidate will be presented to the full board for appointment (to be ratified at the next AGM by shareholders). Should shareholders nominate a candidate for election at an upcoming general meeting, the board will state whether or not it supports the nomination in the explanatory memorandum accompanying the notice of meeting.

Additional information on the roles and responsibilities of the Remuneration and Nomination Committee are set out in the Remuneration and Nomination Committee Charter.

The composition of the Remuneration and Nomination Committee, the Directors’ attendance records, as well as the number of times the Remuneration and Nomination Committee met throughout the 2015/2016 financial year, are reported in the annual report's Meetings of Directors section.

Independence and materiality

All of FLT’s non executive directors are independent directors including the chairman. An independent director is independent of management and free of any business or other relationship that could materially interfere with the exercise of the director's unfettered and independent judgment. Materiality is assessed on a case-by-case basis from the perspective of both the company and the director concerned.

The board believes Gary Smith, John Eales, Cassandra Kelly (resigned 2/8/16) and Robert Baker, are independent having regard to the indicia in Box 2.3 of the ASX Corporate Governance Principles and Recommendations. While businesses which certain directors have an interest in supply product or services to FLT, they are not of a material quantum to those businesses, nor to FLT, to affect the non-executive directors’ independence.

The roles of chairman and managing director are exercised by different individuals, being Gary Smith and Graham Turner respectively.

Further details regarding the length of service of each director and their relevant interests, positions, associations and relationships, is included in the annual report's Information on Directors section.

Board and senior executive induction

Newly appointed board members and senior executives are given a practical induction into the group's operations, strategies, culture and values, meeting arrangements and financial position through access to appropriate documentation and face-to-face discussions with current board members and senior executives.

Appropriate professional development opportunities for directors are also provided in order to allow directors to develop and maintain the skills and knowledge required for them to perform their roles as directors effectively. The company secretary, in conjunction with the board, may from time to time identify professional development courses relevant to the board members.

3. Promote ethical & responsible decision making

FLT actively promotes a set of values designed to assist employees in their dealings with each other, competitors, customers and the community. These values set out standards expected of all employees. Values endorsed include: honesty, integrity, fairness and respect. These values are incorporated into the company core philosophies, which are included in the annual report, and Code of Conduct. The Code of Conduct also outlines the company’s position on lawful and ethical behaviour, conflicts of interest, use of inside information, confidentiality, bribes and facilitation payments, public comments, privacy and harassment, bullying and discrimination.

The board endorses FLT's Code of Conduct and it applies to all directors, officers, employees, consultants and contractors.

In addition, FLT has implemented a Whistleblowing policy and an Anti-Bribery & Corruption policy across its global operations.

The company recognises its corporate social responsibility (CSR) and contributes to several charitable initiatives. The Flight Centre Foundation is a key element in the company’s CSR platform.

Political contributions

FLT maintains a position of impartiality with respect to party politics and, accordingly, does not contribute any funds in this regard.

Trading policy

The board has established guidelines governing trading in FLT shares by directors, senior executives, employees, contractors and people closely connected to FLT’s directors and senior executives. Dealings in FLT's shares are only permitted for 30 days following the public release of the company's price sensitive announcement. If new price sensitive information emerges during this period, directors, senior executives, employees, contractors and closely connected persons are not permitted to trade in FLT's shares until the information has been publicly released. The trading policy also prohibits short-selling and short term dealing in FLT shares at all times. FLT monitors dealing in FLT shares as part of the administration of the policy.

4. Safeguard integrity of financial reporting

Audit and Risk Committee

Audit and Risk Committee functions include:

- reviewing and making recommendations on the adequacy of FLT’s corporate reporting processes;

- reviewing FLT’s financial statements and making recommendations as to whether they reflect the understanding of the committee members of, and otherwise provide a true and fair view of, FLT's financial position and performance;

- assessing the appropriateness of any significant accounting estimates, judgments or choices in FLT’s financial statements;

- recommending the external auditor's appointment/removal, reviewing the auditor's performance and the audit's scope and adequacy;

- advising on procedures in relation to the audit engagement partner's rotation;

- helping the board oversee the risk management framework, including determining the internal audit scope, ratifying the appointment/removal and performance assessment of Enterprise Risk senior managers and risk teams;

- making recommendations on objectivity and performance of the Enterprise Risk team and other risk teams;

- reviewing the company's published financial results

- reporting to the board on matters relevant to the committee's role and responsibilities;

- ensuring timely adoption of, and adherence to, all relevant accounting policy changes;

- reporting to the Board on the effectiveness of FLT’s risk, control and compliance framework and providing assurance on the preparation and review of FLT’s financial statements;

- considering advice from Enterprise Risk on whether FLT is operating efficiently, effectively and in accordance with relevant laws and regulations; and

- scrutinising financial and other risks.

Committee composition

The Audit and Risk Committee consists of FLT’s independent non-executive directors;, Robert Baker (appointed chairman September 2013), Gary Smith, John Eales and Cassandra Kelly (resigned 2/8/16), who have extensive experience and expertise in accountancy, financial management, risk management, legal compliance and corporate finance. Details of the directors’ qualifications are set out in the annual report's Information on Directors section.

The board has reviewed the committee's composition and is satisfied that, given the size of FLT's board, the committee has appropriate financial representation. The Audit and Risk committee chairman is not the board's chairman.

Committee meetings

Directors’ attendance records, as well as the number of times the Audit and Risk Committee met throughout the 2015/2016 financial year, are reported in the annual report's Meetings of Directors section.

Auditor appointment

The company and Audit and Risk Committee policy is to appoint an external auditor that clearly demonstrates quality and independence. The external auditor's performance is reviewed annually. Ernst & Young (EY), the current auditor, is obliged to rotate audit engagement partners at least every five years. EY was appointed FLT’s auditor at the 2013 AGM, after a competitive tender and evaluation process where, competency, experience, price, business understanding and global network were key factors considered.

An analysis of fees paid to the external auditor, including fees for non-audit services, is provided in the annual report. The external auditor's policy is to provide the Audit and Risk Committee with an annual declaration of independence.

Certification of financial reports

A decision by the board to approve FLT’s financial statements for a financial period is subject to receipt, from the MD and CFO, of a declaration in accordance with section 295A of the Corporations Act 2001 (Cth) and recommendation 4.2 of the ASX Corporate Governance Principles and Recommendations.

Auditor communication

The external auditor attends every annual general meeting to answer shareholder questions concerning the conduct, preparation and content of the audit report.

5. Make timely and balanced disclosure

FLT has written policies and procedures governing continuous disclosure and shareholder communication.

In accordance with ASX Listing Rules, the company will immediately disclose publicly any information that a reasonable person will expect to have a material effect on the value of its shares.

All information communicated to the Australian Securities Exchange (ASX) is posted on the company website.

The annual report is available on the company's website and, on request, can be emailed or posted to shareholders.

6. Respect rights of shareholders

Shareholder communications

The board aims to inform shareholders of all major developments affecting the group's activities and its state of affairs through distribution of the annual report, ASX announcements and media releases. All such communications (including historical announcements for at least the previous three years) are placed on the company website.

To facilitate and encourage participation at meetings of security holders, shareholders are encouraged to supply, prior to the annual general meeting, any questions of the board so that these can be addressed at the meeting. To further encourage participation, FLT's investor relations manager is available at other times to address shareholder, analyst and media queries. Security holders are able to receive communications from the company and the share registry electronically.

The investor relations manager maintains a register of analyst and investor briefings and supplies teleconference facility details at the end of the results announcements (if held) for shareholders to be fully informed. Where possible, recordings are made available on the company’s website.

7. Recognise and manage risk

Risk management is good management and is all employees' responsibility.

While FLT does not have a separate risk committee, the board, through the combined Audit and Risk Committee, is responsible for overseeing the company’s integrated risk and compliance management framework. This provides the board and management with an ongoing program to identify, evaluate, monitor and manage significant risks to enhance, over time, the value of the shareholders' investments and to safeguard assets.

The Audit and Risk Committee’s charter is available on FLT’s website.

The framework is based around the following risk initiatives, as set out in the risk management policy:

- Risk identification – identifying significant, foreseeable risks associated with the business

- Risk evaluation – evaluating risks in terms of impact and likelihood

- Risk treatment/mitigation – developing appropriate mitigation to keep the risk within an acceptable level; and

- Risk monitoring and reporting – ongoing reporting, usually on an exception basis on the status of the risk

Risks are identified and evaluated against achievement of strategic objectives, as well as more operational activities. The risk management policy is reviewed annually and was reviewed during the 2015/2016 financial year.

The MD and senior management are responsible for identifying, evaluating and monitoring risk. Senior management personnel are responsible for ensuring clear communication of their position on risk throughout the company. A self-assessment on significant business risks is conducted in all geographies and reported to the Audit and Risk Committee. Risks considered include strategic, operational, regulatory and compliance matters.

The Enterprise Risk team plays an integral role in deploying and monitoring this self assessment, in addition to using the results from this assessment in designing its internal audit plan and testing key control areas. The Enterprise Risk team reports independently on the status of these key controls to the Audit and Risk Committee and works closely with the legal and company secretariat teams.

A broader risk assessment also takes place over significant capital injections, joint venture or business initiatives.

FLT and its board continually assess emerging trends and associated risks and their possible affects on future profits.

The MD and CFO have provided the board with a formal sign-off on the group’s financial statements, in accordance with section 295A of the Corporations Act and recommendation 4.2 of the ASX Corporate Governance Principles and Recommendations, that sign-off is founded upon a sound system of risk management and internal control which is operating effectively in all material aspects in relation to financial reporting risks.

Risk Profile

Risks to which FLT is subject to include:

- The general state of the Australian and international economies;

- Adverse currency and interest rate movements;

- The outlook of the tourism sector generally;

- Low barriers to entry and modest start-up costs;

- Adoption of the internet as a distribution channel;

- Adverse changes in margin arrangements or rates payable to the group;

- The occurrence of significant international armed conflict;

- A dramatic change in customer travel/leisure patterns and tastes;

- Loss of key staff and staff turnover; and

- Adverse changes in government regulation.

FLT and its board continually assess emerging trends and associated risks and their possible affects on future profits.

The company has a proven retail formula based on standardised systems, a replicable business model and ongoing business growth. This business model has been, and continues to be, successfully adapted in response to world events and industry changes. In compliance with recommendation 7.4 of the ASX Corporate Governance Principles and Recommendations, FLT discloses details of its exposure to economic, environmental and social sustainability risks and the strategies it has implemented in relation to these risks in the Directors’ Report.

8. Remunerate Fairly and Responsibly

Full details of FLT's remuneration policies and structures, including director and key management personnel information, are outlined in the remuneration report in the annual report.

A summary of the Remuneration and Nomination Committee's responsibilities is included above at item 2 and additional information can be found in the Remuneration and Nomination Committee charter.

All relevant governance charters and policies are available on www.fctgl.com/investor-and-media/governance